The formula to calculate average accounts receivable is as follows:Īverage Accounts Receivable = (BOP Balance + EOP Balance) / 2 It is calculated by adding the period's beginning balance and end balance and dividing by two. Net Credit Sales = Gross Credit Sales - Sales Returns - Sales AllowancesĪverage accounts receivable is the average balance that is found in this account. The equation for calculating net credit sales is: Net credit sales are calculated by subtracting returns and allowances from gross credit sales.Īllowances are any discounts that are given on the sale of an item. Using net sales, in general, would include cash sales which would not fully represent the rate at which companies collect their receivables. Net credit sales are the sales that are made on credit.Īccounts receivable does not include cash sales but only credit sales which are collected at a later date. The formula to calculate it is as follows:ĪRT = Net Credit Sales / Average Accounts Receivable It is used to measure the rate at which a company can collect its earnings from credit sales. The accounts receivable turnover ratio is a common investment analysis and accounting metric.

ACCOUNTS RECEIVABLE TURNOVER RATIO HOW TO

How to Calculate Accounts Receivable Turnover Ratio However, as a rule of thumb, the higher the turnover ratio, the better the return prospects for the company. As a result, they can't carry as high a debt load, meaning their AR turnover ratio should be higher. On the other hand, smaller companies often operate with tighter margins. Larger businesses can operate with lower ratios because they have more capacity to carry a high level of debt without impacting their cash flow. It is therefore vital to only compare turnover ratios of companies in like industries that have similar business models.įailure to do so may lead to an unreliable understanding of how high or low a company's ratio is or should be. Therefore, even among companies operating in similar industries, the ratio may not be comparable due to different business models. However, an important point to note is that different industries have different turnover ratios.

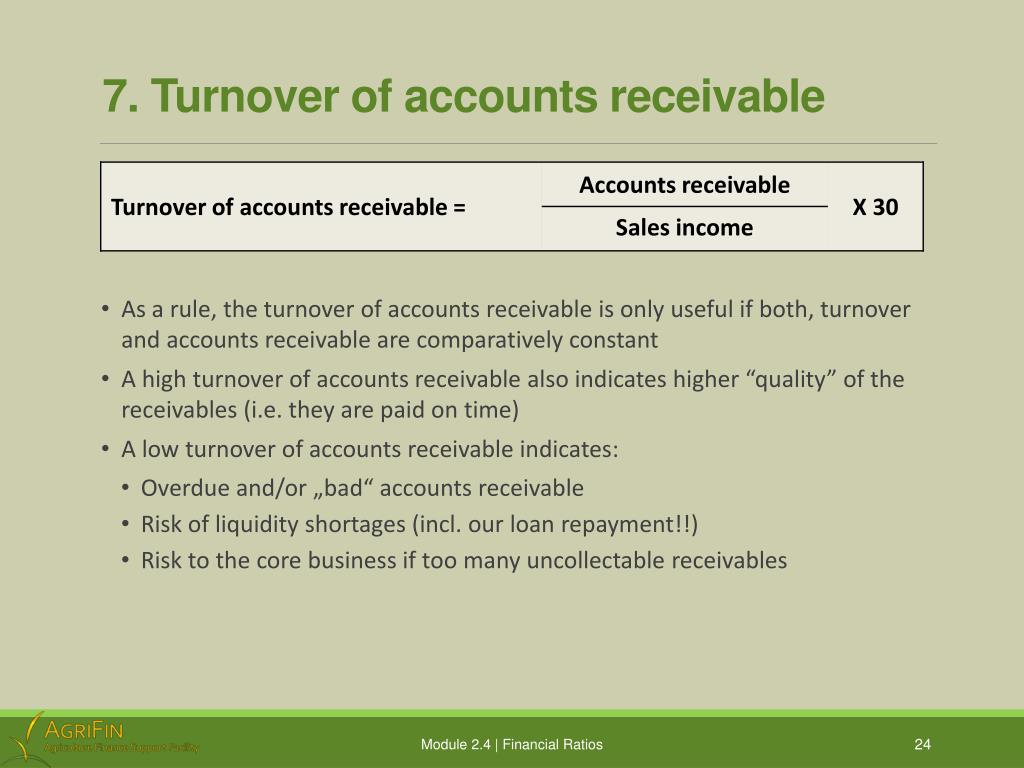

It also means a lower working capital requirement, which significantly reduces the capital employed, thereby boosting its return on capital employed ( ROCE). On the other hand, the better a company is at collecting its debts, the sooner it can pay its expenses and reinvest in operations. This negatively impacts its liquidity as it does not have cash, rather only a claim on cash, which it cannot use to pay creditors and expenses or make purchases. This ratio is useful for several reasons. The lower a company's AR turnover ratio is, the longer and more difficult it is to collect from its debtors. More specifically, this metric shows how many times a company has turned its receivables into cash throughout a specific period. This legal claim that the customers will pay for the product, is called accounts receivables, and related factor describing its efficiency is called the receivables turnover ratio.The account receivable (AR) turnover ratio measures a company's ability to collect money from its credit sales. To keep track of the cash flow (movement of money), this has to be recorded in the accounting books (bookkeeping is an integral part of healthy business activity). Net credit sales is the revenue generated when a firm sells its goods or services on credit on a given day - the product is sold, but the money will be paid later. Simple enough, right? As long as you get paid or pay in cash, sure, the act of buying or selling is immediately followed by payment.īut what happens when you pay using a credit card? You still get your product, but the payment is deferred - meaning it is put off to a later time.Īccounting works on a similar mechanism. Want to order that delicious pizza slice? Well, you have to buy it, i.e., pay for it, there and then. Normally whenever you sell something, you get paid immediately. If you want to quickly understand what is the accounts receivables turnover ratio formula, but don't want to get overwhelmed by a brainful of accountings terms, let's go back a little bit and start from the beginning.

0 kommentar(er)

0 kommentar(er)